Deputy Governor, Bangladesh Bank Abu Farah Md. Nasser said, “Our key focus is to control both the import and inflation and promote local production for generating employment. For this, we have announced a new Credit Guarantee Scheme (CGS) on Refinancing against Term Loan of BDT 250 billion, of which 75% for cottage micro and small and the remaining for medium enterprises.”

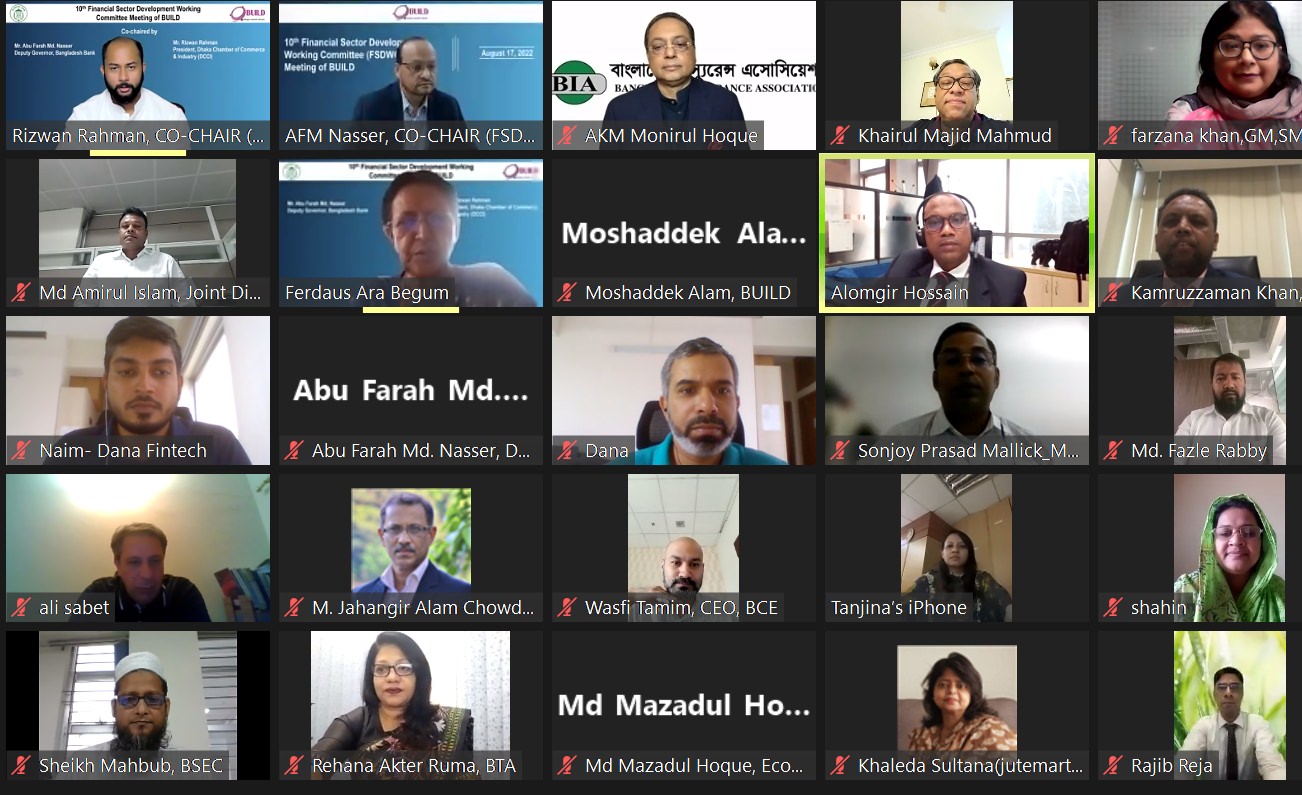

The Deputy Governor spoke at the 10th Financial Sector Development Working Committee (FSDWC) Meeting organized by Business Initiative Leading Development (BUILD) on August 17, 2022. Abu Farah Md. Nasser, Deputy Governor of Bangladesh Bank (BB), and Rizwan Rahman, President of Dhaka Chamber of Commerce and Industry (DCCI), co-chaired the meeting.

He further said that an open interest cap would pile more stress on small-business owners struggling with debt and add more cost to production, thus highly influencing the cost of business. He said that Bangladesh Bank is trying to combat inflation and, at the same time, ensure employment generation where CMSMEs play a vital role.

DCCI President Rizwan Rahman said that WEs should be aware of all policy changes of the regulators, and the women chambers should shoulder responsibilities to come forward in educating their members about all existing regulatory benefits they can avail. He recognized that we need to change our focus from collateral-based finance to cash flow-based finance which BB is doing now.

BUILD CEO Ferdaus Ara Begum delivered two presentations on Constraints of Availing Financial Support of Women Entrepreneurs and Overseas Equity Investment Rules 2022. The studies covered four refinancing schemes and four financial schemes by BB. It also analyzed several schemes by Banks and Financial institutions in collaboration with Fintech firms. The study also covered several CGS facilities announced by the Central Bank.

She urged the central bank to enhance support for the CMSMEs after COVID-19 with collateral/individual collateral or third party collateral or social collateral since they do not have assets for collateral. She also said that under the CMSME Loan Categorization of Bangladesh Bank, trading and some non-traditional sectors come up so that the financial institutions can fund them. They cannot get funds since they are not under CMSME Loan Categorization.

For the ease of availing of finance, she underscored the need for advisory support, documentation support, format for Financial reports etc. Earlier, she informed me that out of 13 policies recommended in the last meeting; eight have already been implemented.

Md. Amirul Islam, Deputy Director of Bangladesh Bank, appreciated the study on Equity Investment of BUILD and informed that BB has already given permission USD 70 million and repatriated USD 40 million and told some policies of BB for supporting investments other than exporters.

SMEF GM Farzana Khan said that SMEF has already identified 177 clusters, and a definition will be included in the upcoming industrial policy, which is aligned with BB definitions. Wasfi Tamim, CEO, Bangladesh Center of Excellence, said that we need robust monitoring in place. Our focus should not be only on the total value but on the number of enterprises that benefit from the central bank’s financial scheme. Among other Md. Jahangir Alam Chowdhury of the University of Dhaka, Fauzia Hoque FCA, AKM Monirul Hoque from Bangladesh Insurance Association, Khairul Majid Mahmud, former Director, DCCI, Md. Mazedul Hoque, Kamruzzaman Khan from Lanka Bangla, and Naim Rahat of Dana Fintec spoke on the occasion.

The working committee meeting was participated by the committee members, representatives of the central bank, ICAB, BSEC, Ministry of Finance, a number of scheduled banks, academicians, business chambers and associations, entrepreneurs from the private sector, and so on.

The Financial Sector Development Working Committee (FSDWC) of BUILD aims to hear from the private sector and demonstrate the financial industry with the commitment to providing a conducive business environment. FSDWC endeavours to meet the needs of an evolving financial sector in the country.

Enclosed are the press releases (in English and Bangla) for your kind consideration. Please feel free to contact us for any queries.