Mahbubul Alam Takes Charge As the Chairperson of BUILD

Mahbubul Alam, President of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), the apex trade organisation of the country and the former president of the Chittagong Chamber of Commerce and Industry (CCCI), has taken over as the Chairperson of the Trustee Board of the Business Initiative Leading Development (BUILD) for the year 2024-25.

He succeeded Nihad Kabir, a senior advocate and a former president of the Metropolitan Chamber of Commerce and Industry (MCCI). She was the Chairperson of BUILD in 2022-23. The transition took place on 4 February 2024, as the outgoing Trustee Board (2022-23), led by Nihad Kabir, handed over the responsibilities to the new board at the 33rd Trustee Board Meeting held at the BUILD Conference Room in Motijheel, Dhaka.

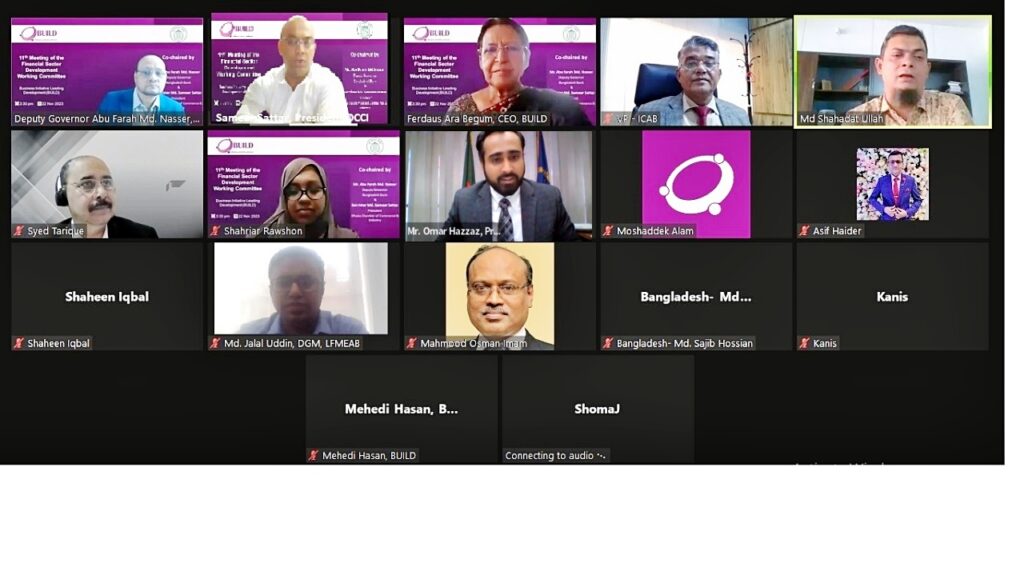

The newly formed Trustee Board for 2024 includes Ashraf Ahmed, President of the Dhaka Chamber of Commerce and Industry (DCCI), Kamran T. Rahman, President of the Metropolitan Chamber of Commerce and Industry (MCCI), Omar Hazzaz, President of The Chittagong Chamber of Commerce and Industry (CCCI), Afsarul Arifeen, Secretary General of DCCI, Farooq Ahmed, Secretary General of MCCI, Engr. Mohd. Farque Ahmed, Secretary of CCCI. Ferdaus Ara Begum will serve as the Member Secretary to the Trustee Board.

Abul Kashem Khan, Director of FBCCI and the Former President of DCCI, will continue as a nominated trustee board member from the DCCI, while Saiful Islam is a nominated trustee board member from the MCCI.

The press releases — in Bangla and English — are included for your use. Please get in touch with us if you have any queries.

Mahbubul Alam Takes Charge As the Chairperson of BUILD Read More »